Weekly Review: Markets rise on Improved Geopolitical, Trade Outlook

- Jul 1, 2025

- 4 min read

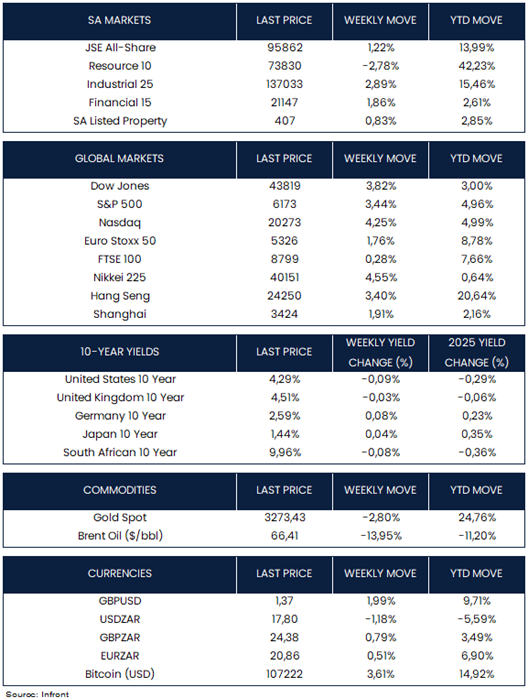

U.S. stocks rallied over the week, lifted by a string of positive developments, including easing tensions in the Middle East, dovish signals from several Federal Reserve officials, news of a signed U.S.-China trade deal and indications from U.S. policymakers that further trade deals were nearing completion. The S&P 500 gained 3.4% and the Nasdaq rose 4.3% - both closing at record highs. The Dow Jones Index also managed a 3.8% w/w gain.

On the U.S. economic data front, the Fed’s preferred inflation measure ticked up slightly in May, with core PCE rising 0.2% m/m and 2.7% y/y, both just above estimates. Personal income and spending both declined, missing forecasts. Meanwhile, consumer inflation expectations for the year ahead fell sharply from 6.6% to 5%, and the University of Michigan’s consumer sentiment index jumped 16% to 60.7.

NATO Secretary General Mark Rutte announced this week that all member states are on track to meet the 2% of GDP defence spending goal, with plans to raise that to 5% annually by 2035. Germany said it will increase defence spending by two-thirds by 2029. Just before the meeting in The Hague, the EU and Canada signed a new security pact, strengthening their defence ties. Following the summit, Trump reaffirmed U.S. support for NATO’s Article 5 mutual defence commitment.

European Central Bank President Christine Lagarde said that the central bank anticipates slower short-term growth but expects inflation to settle sustainably around the 2% target. Bank of England Governor Andrew Bailey told parliament that UK monetary policy focuses more on domestic rather than international factors, noting a softening labour market and rising economic slack. He said interest rates will likely decline gradually and cautiously. In market activity, the Euro Stoxx 50 rose 1.8% while the FTSE 100 eked out a 0.3% gain.

Japan’s stock market saw strong gains this week, with the Nikkei 225 rising 4.6%. Technology stocks performed well, boosted by reduced fears of a global trade war and early indications that the Iran-Israel ceasefire is holding, helping lift investor risk appetite.

Mainland Chinese stocks rose after the U.S. and China finalised a trade framework from last month’s Geneva talks. The Shanghai Composite rose 1.9%, and Hong Kong’s Hang Seng jumped 3.4%. The framework, announced by U.S. Commerce Secretary Howard Lutnick, eased trade tensions temporarily. Beijing confirmed parts of the deal, including commitments on rare earth exports, but details were limited and key issues like fentanyl trafficking were not addressed.

On the commodity front, oil prices fell over 18% from Monday’s highs to Tuesday’s lows before stabilizing in the mid-$60s as the near-term threat of a disruption to Middle East oil supplies receded (Brent Oil, -14% w/w). Gold dipped -2.8% w/w as risk sentiment improved globally.

Market Moves of the Week:

South Africa recorded its first consecutive primary budget surplus in 16 years, underscoring a renewed focus on fiscal discipline. The SA Reserve Bank’s latest Quarterly Bulletin showed a surplus of R48.9 billion ($2.8 billion), or 0.7% of GDP, for the year ending March 2025. While this aligns with the National Treasury’s May forecast, it falls short of the earlier R61 billion estimate for 2024. The surplus is likely to be welcomed by investors and the unity government, which delivered its first budget after months of political wrangling over tax hikes.

President Ramaphosa’s dismissal of DA Deputy Minister of Trade, Industry and Competition Andrew Whitfield without explanation has strained the fragile government of national unity. The DA claims Whitfield was fired for traveling abroad without approval, while ANC members implicated in corruption remain in office. Despite calling the move an “assault,” the DA backed the national budget bill, saying their support was for the country, not politics.

The All-Share Index rose by 1.22% this week, held back by losses in Resources (-2.78%). The local currency strengthened against the U.S. dollar, moving to R17.80/$ from last week’s R18.01/$ level. SA government bond yields moved lower on the week, dipping 0.08%.

Chart of the Week:

Important Information

The information included above as well as individual companies and/or securities mentioned should not be construed as investment advice, a recommendation to buy or sell or an indication of trading intent on behalf of any Kanga Wealth Management or Strategiq product. This material is provided for informational purposes only and is not intended to be investment advice or a recommendation to take any particular investment action. Information contained herein is based upon sources we consider to be reliable; we do not, however, guarantee its accuracy. All charts and tables are shown for illustrative purposes only.

Source: STRATEGIQ Capital, an authorised financial services provider (FSP 46624)

![Kanga Wealth Final Logos 2024 (With Partner Logo) Solid Colour [Recovered]_Bigger Growth H](https://static.wixstatic.com/media/6a310d_f3789a29ebba43cb8993cb33f9e6a22d~mv2.png/v1/fill/w_980,h_279,al_c,q_85,usm_0.66_1.00_0.01,enc_avif,quality_auto/Kanga%20Wealth%20Final%20Logos%202024%20(With%20Partner%20Logo)%20Solid%20Colour%20%5BRecovered%5D_Bigger%20Growth%20H.png)